Market Reports

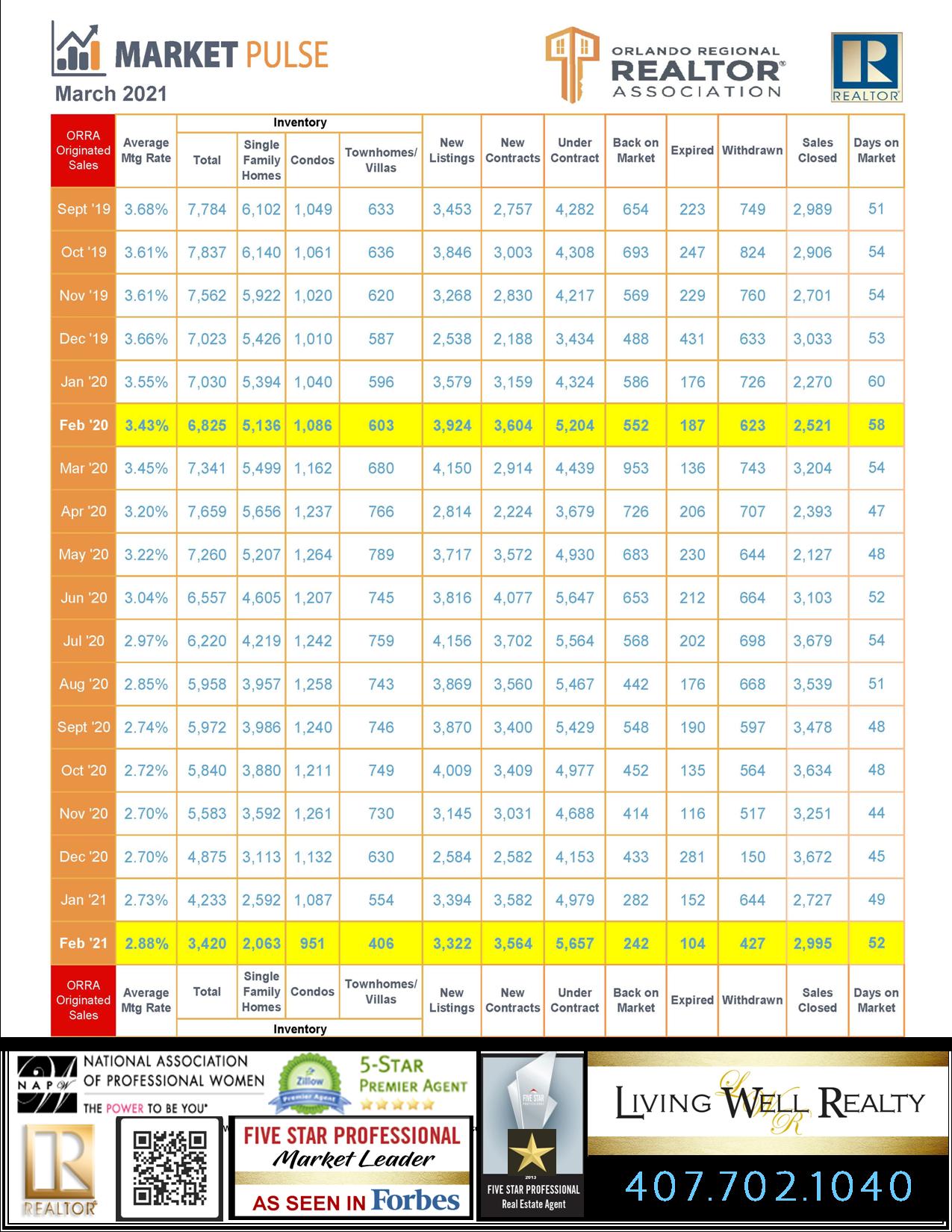

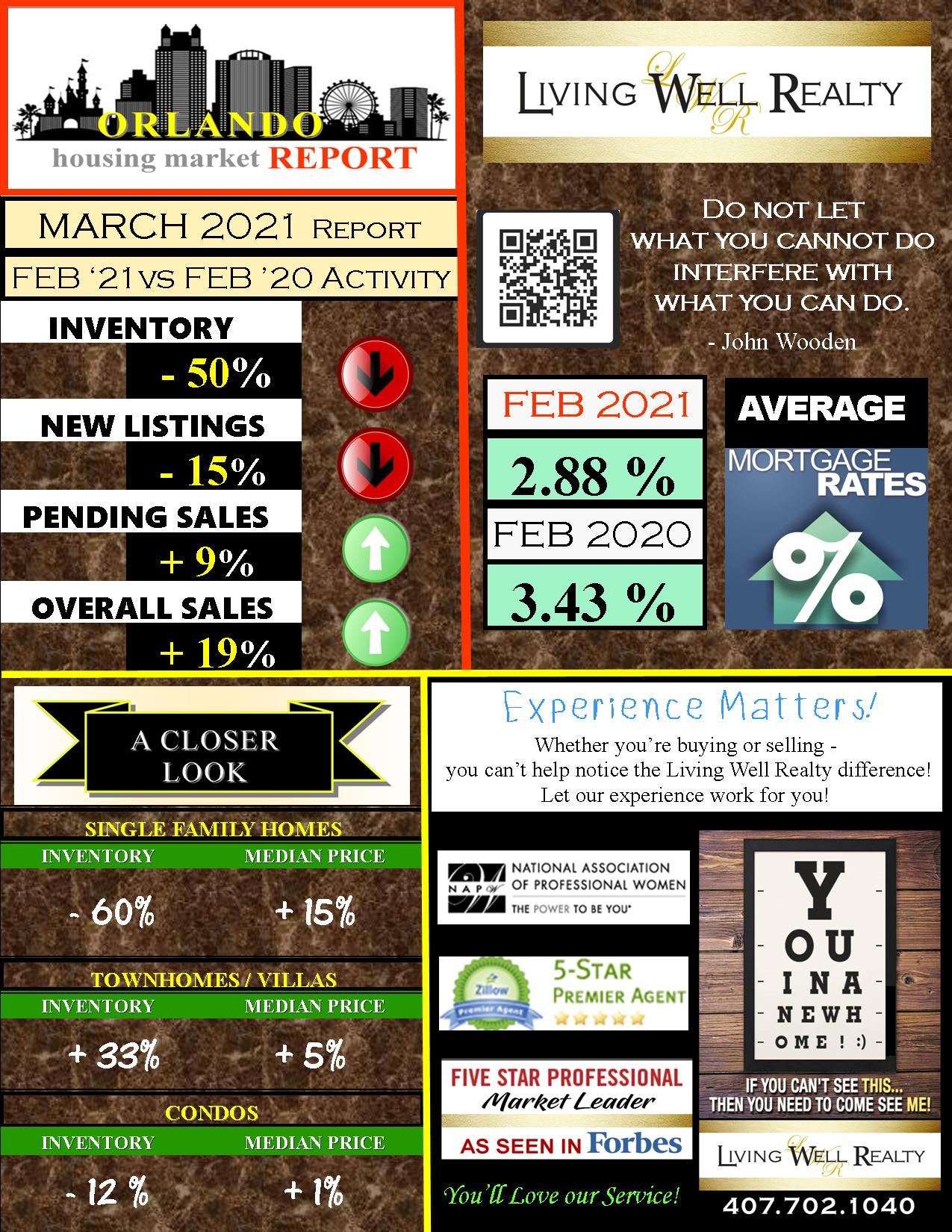

MARCH 2021 – Summary for FEBRUARY 2021 vs FEBRUARY 2020

This month’s report shows a continued squeeze on the number of homes for sale

INVENTORY IS THE LOWEST SINCE MAY 2005!

The supply of homes stands at 1.14 months, less than half of what it was in February 2020- so you have a frame of reference – a healthy housing market has a 6 month supply of inventory.

Interest rates continued to rise for a second straight month to an average of 2.88% in February 2021. That number, however, is still lower than the interest rate in February 2020, which was 3.43%

Sellers are receiving multiple offers, often above their asking price, and buyers are engaging in bidding wars with people looking to move to Orlando from other states

The Orlando area inventory is down 50% in February 2021 from February 2020

The number of new listings decreased 15% in February 2021 from February 2020

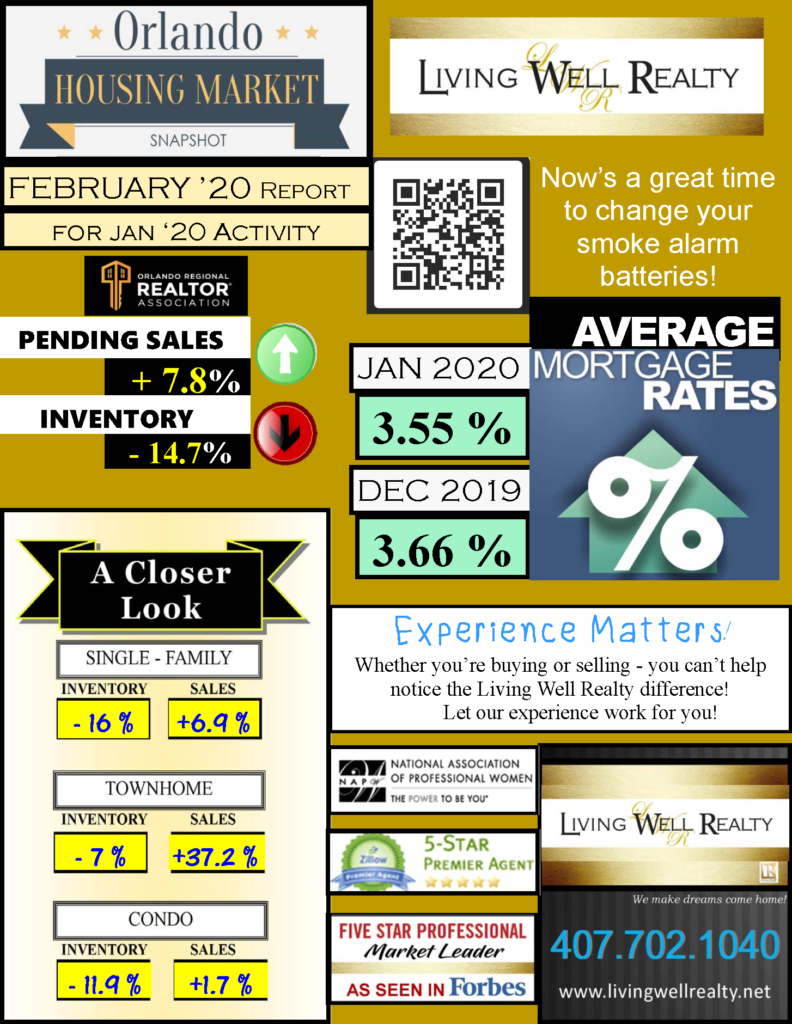

FEBRUARY 2020 – Summary for JANUARY 2020 activity

Orlando home sales, median price jump as inventory plummets in January

Orlando’s housing market in January marked a second consecutive month of double-digit year-over-year sales increases. Sales improved by more than 16 percent compared to January 2019, while the median price experienced an 8 percent increase.

However, the numbers of homes available for purchase in Orlando dropped by nearly 15 percent.

For Buyers: Interest rates continue to be extremely favorable.

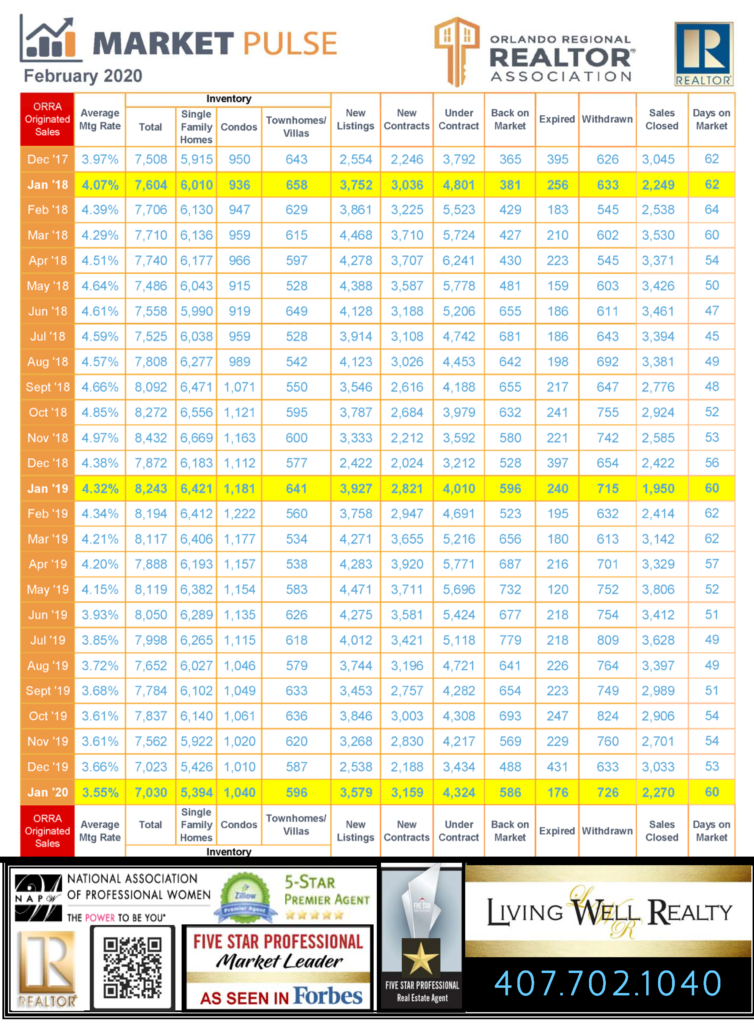

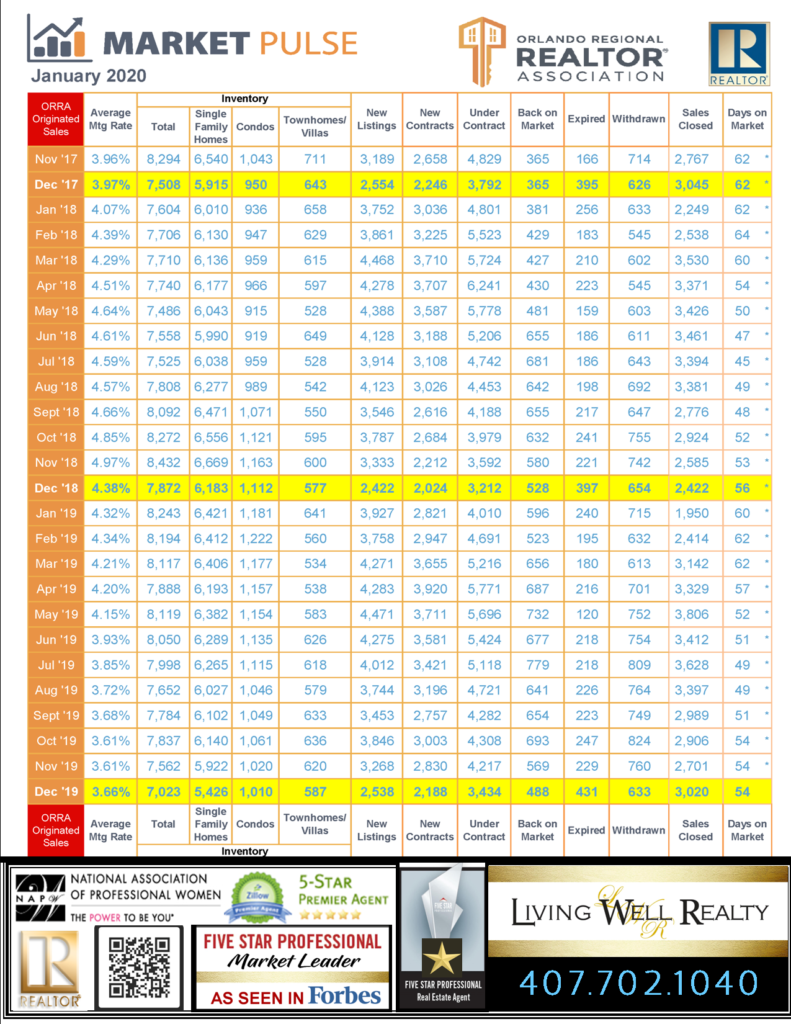

JANUARY 2020 – Summary for DECEMBER 2019 activity

Orlando Housing Market closes out 2019 with slight increases in median prices and sales

Orlando’s annual median home price for 2019 is 4% higher than the 2018 annual median price, while annual sales are 2% above that in 2018.

For all of 2019, the inventory of available homes saw an increase of 1% in compared to 2018.

Orlando home sales completed during 2019 racked up 1.8% above the cumulative sales for 2018.

For a bit of historical comparison, annual sales in 2018 were 3.2% lower than in 2017.

NOV 2019 – Summary for OCTOBER 2019 activity

Updates on Interest Rates – Home Sales

Orlando’s housing market in recorded:

** Pending sales in October are up 8.3% compared to October of last year

** 6% year-over-year increase in median price and a small 1% decrease in sales in October.

** Available for sale inventory of homes is on a declining trend for the third consecutive month, decreasing 5%

The average interest rate paid by Orlando home buyers in October was 3.61%, down from 3.68% the month prior.

Low inventory translates into opportunity for sellers

Declining interest rates mean greater purchasing power, which is alluring to buyers

OCT 2019 – Summary for SEPTEMBER 2019 activity

Updates on Interest Rates – Home Sales

According to the latest monthly report from ORRA, Orlando area homebuyers secured an average interest rate of 3.68% in September. That’s down from 4.66% in Sept ’18 and a high this year in February of 4.34%.

Single Family Homes – The median price for single-family homes that changed hands in September increased 8.8% over September 2018.

The inventory of this home type decreased by 3.8% over September 2018

Condo Update: Condo sales are up by 2.1%; condo inventory is up by 2.1%

Great news for First Time Homebuyers:

The first-time homebuyers affordability index increased to 97.87% from to 95.33% last month.

Summary for JULY 2019 activity

Updates on Interest Rates – Home Sales

Great news on Interest Rates: According to the latest monthly report from ORRA, Orlando area homebuyers secured an average interest rate of 3.93% in June. That’s down from 4.15% in May and a high this year in February of 4.34%.

Single Family Homes – The median price for single-family homes increased by 3% to $270,000 in June. The inventory of this home type improved by 5% over June 2018

Condo Update: Condo sales are up by 3% (406); condo inventory is up by 24%

Despite inventory gains, Orlando is still clearly a seller’s market as it has only 2.37 months of supply (six months is considered by economists to indicate a market that is balanced between buyers and sellers).

Summary JUNE 2019

Orlando sales head up as summer homebuying season kicks in

Encouraged by continued low interest rates and a favorable economy that is drawing droves of new residents to Orlando, area homebuyers pushed sales into positive territory for the month of May. Home sales jumped by nearly 11 percent compared to May 2018, which is the first year-over-year increase in 2019.

Summary MAY 2019

In spite of a 1 per cent drop in median price, Orlando has just 2.38 months of supply. Since six months of supply is considered by economists to indicate a market that is balanced between buyers and sellers, Orlando is clearly still a seller’s market. However, the balance shifts when you consider price categories, with the lower price categories firmly favoring sellers and the higher price categories ($600,000 and above) favoring buyers.

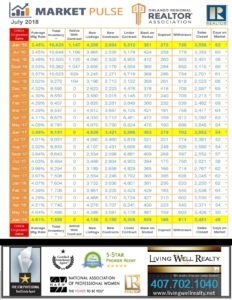

Summary JULY 2018

Orlando’s meager inventory continues to stifle sales, but drives prices up.

THE MEDIAN PRICE OF ORLANDO HOMES SOLD DURING THE MONTH OF JUNE INCREASED MORE THAN 6.8 PERCENT –

DUE TO LOW INVENTORY – SALES DECREASED – HOWEVER BUYER DEMAND CONTINUES TO BOOST AREA MEDIAN PRICES.

Inventory continued its year-over-year slide but registered the smallest decline this year: 17.3 percent.

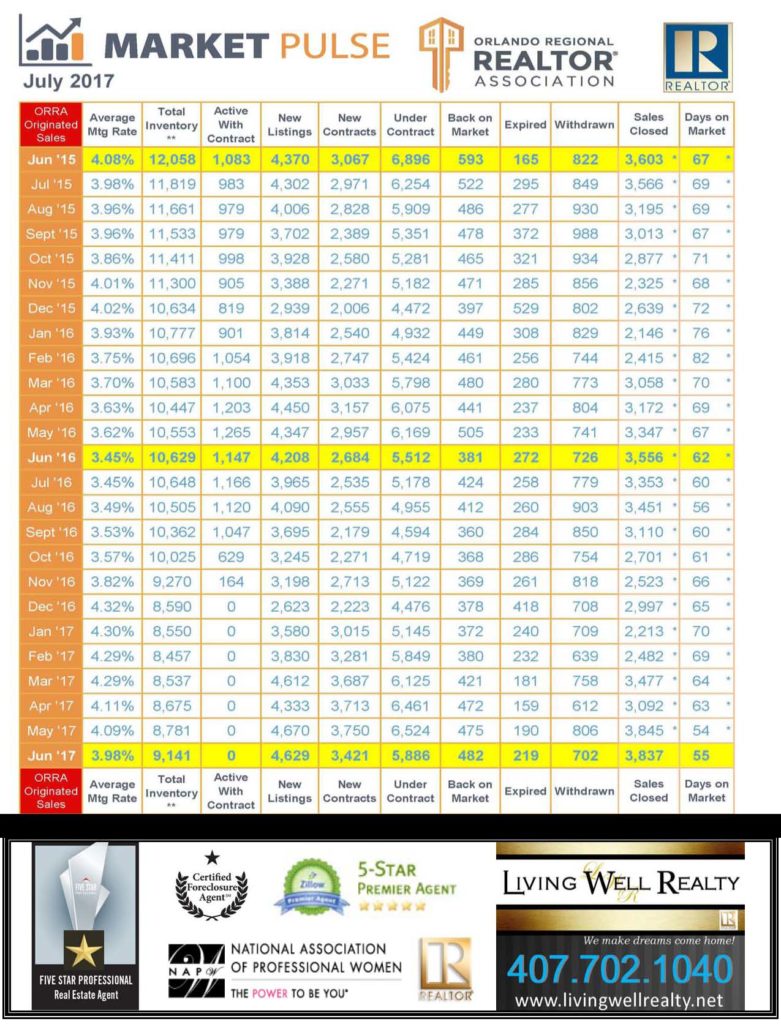

Summary JULY 2017

Orlando median price, sales on the rise and inventory slide decelerates

THE MEDIAN PRICE OF ORLANDO HOMES SOLD DURING THE MONTH OF JUNE INCREASED MORE THAN 7 PERCENT –

WHILE SALES LIKEWISE CLIMBED NEARLY 8 PERCENT COMPARED TO JUNE 2016.

Inventory continued its year-over-year slide but registered the smallest decline this year: 14 percent.

Look to see inventory increase in the months ahead.

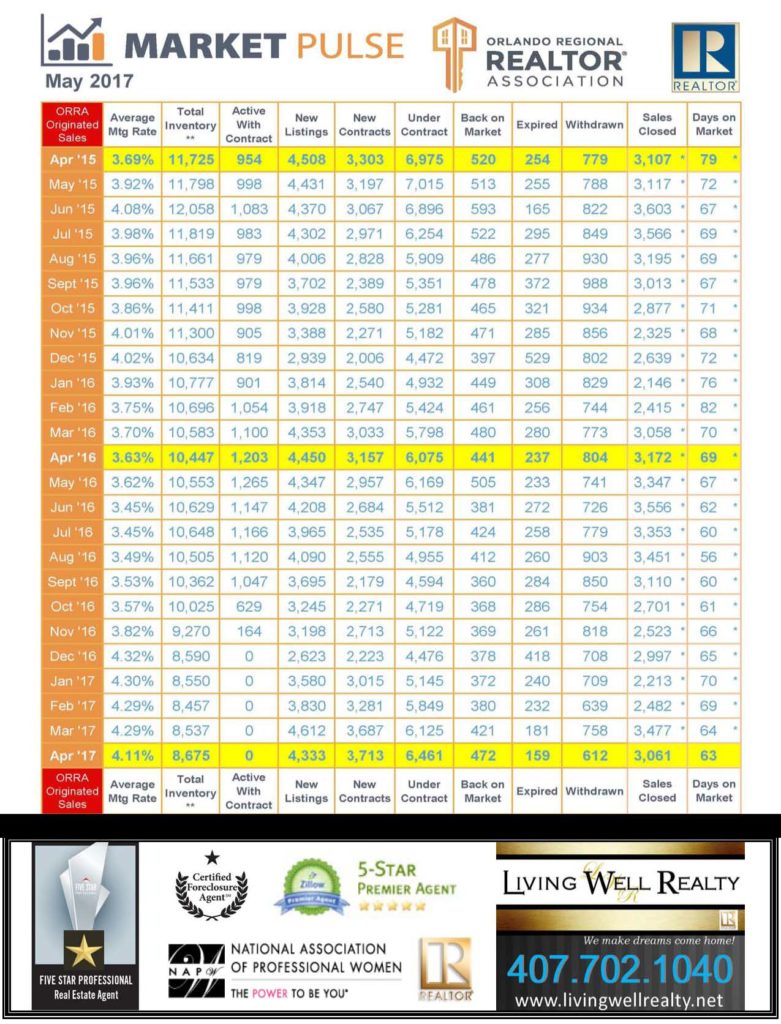

Summary JUNE 2017

Sales and median price increase as interest rate dips during Orlando’s homebuying season

Orlando home sales increased 14 percent in May compared to May of 2016 while the median price jumped 7 percent. Inventory continued its year-over-year slide and dropped by 16.8 percent, but a small relief was found in the 1 percent increase in the number of homes available in May compared to April.

Summary MAY 2017

Orlando median home price continues upward climb as sales and inventory dip

Orlando home sales declined 4 percent in April compared to April of 2016, in large part the result of sustained declines in the number of homes available for purchase. Orlando’s skimpy inventory also continued to push prices upwards, with the area’s year-over-year median home price again hitting a double-digit increase.

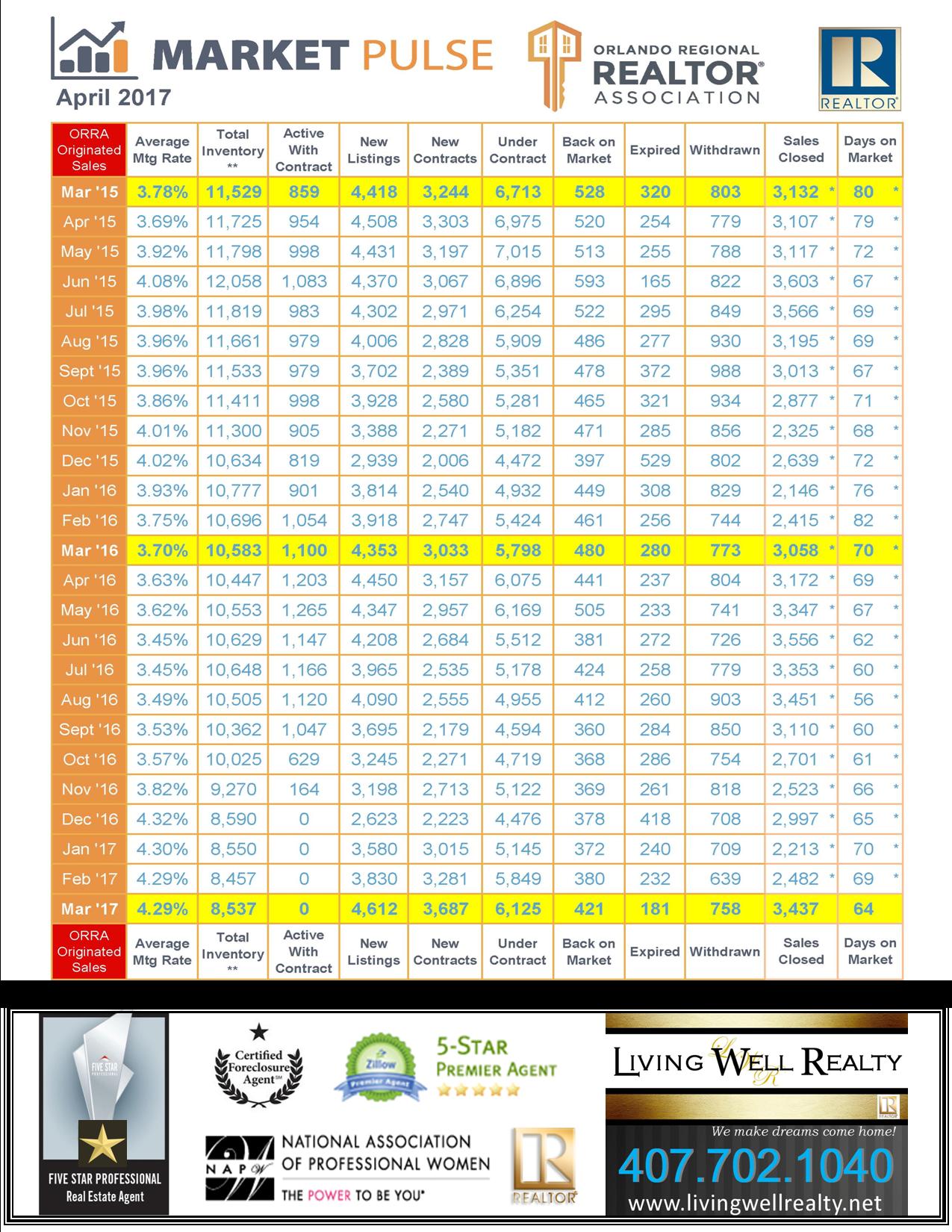

Summary APRIL 2017

Sales activity versus available inventory drives Orlando’s supply of homes to its lowest point since 2013.

Buyer activity during the month of March pushed the supply of homes available for purchase in Orlando to just 2.48 months’ worth, the lowest since May of 2013. Housing economists consider six months of supply to indicate a market that is balanced between buyers and sellers.

Summary MARCH 2017

Orlando median price jumps 11 per cent – sales hold steady while inventory plummets.

THE ORLANDO HOUSING MARKET EXPERIENCED INCREASES IN BOTH MEDIAN PRICE and SALES IN FEBRUARY, WHILE INVENTORY OF HOMES AVAILABLE FOR PURCHASE SHRANK BY 21 PER CENT IN COMPARISON TO FEBRUARY OF 2016.

Summary FEBRUARY 2017

Orlando home sales increase 2 percent as median price jumps 11 percent in January!

The Orlando housing market experienced increases in both median price and sales in January, while the pool of available homes for purchase shrank by 21 percent in comparison to January of last year.

Summary JANUARY 2017

Orlando housing market ends 2016 with increases in cumulative median price and sales

Orlando’s 2016 annual median price ($200,000) is a healthy 12.0 percent higher than the 2015 annual median price ($178,500), thanks to another 12 months of year-over-year price increases. Sales for 2016 finished out at 35,780 and squeaks in at 1.8 percent above the cumulative sales total of 35,151 for 2015

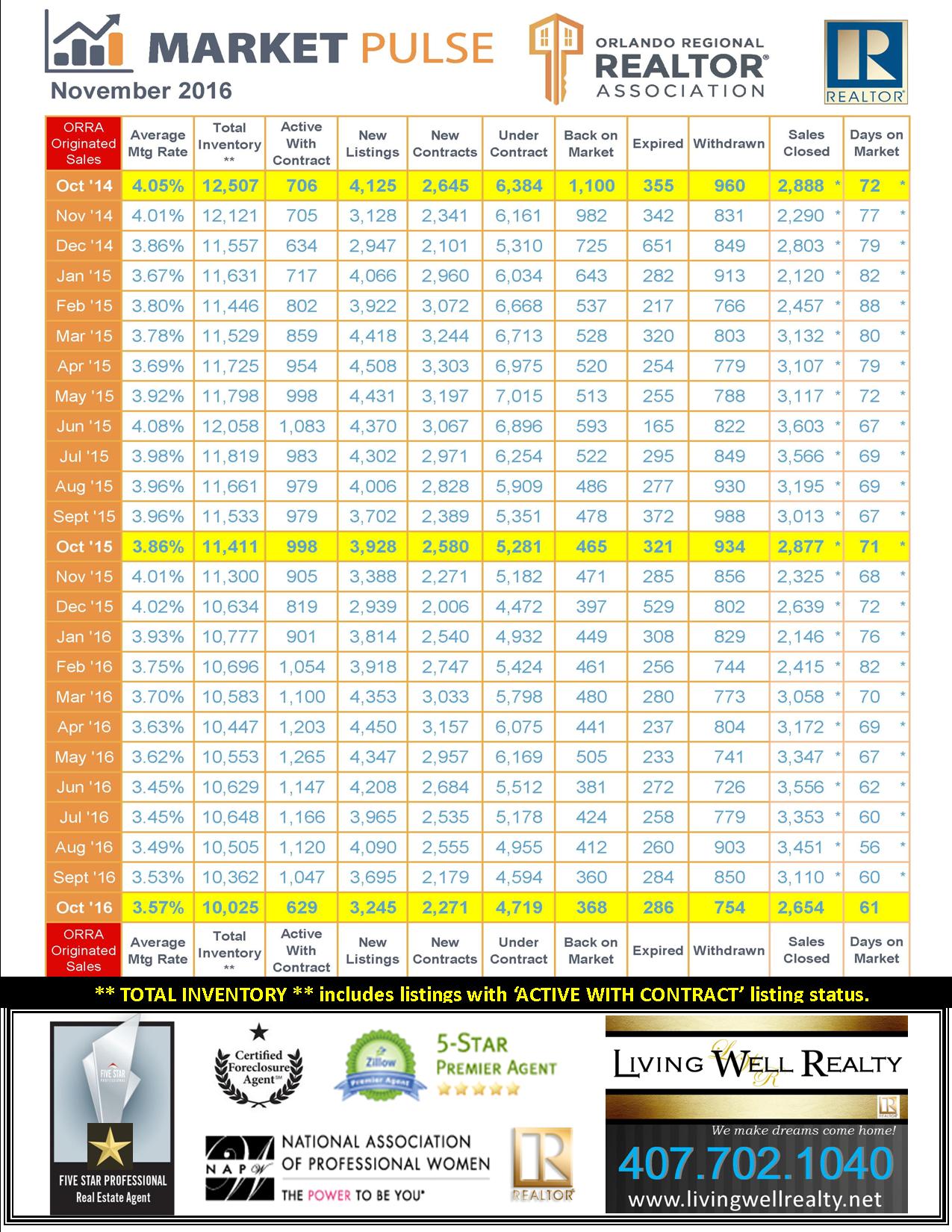

Summary DECEMBER 2016

Orlando home sales, median price increase along with mortgage rate in November.

Orlando home sales experienced a 7 percent year-over-year jump in November, along with a 9 percent increase in median price. The average interest rate paid by an Orlando homebuyer is November is 3.82 percent, up from 3.57 percent.

Summary NOVEMBER 2016

Orlando median price continues its upward trend as sales and inventory slip.

The median price of Orlando area homes rose 14 percent year-over-year in October. Meanwhile, sales decreased 8 percent as inventory took its greatest year-over-year tumble in 2016 and dropped by 12 percent.

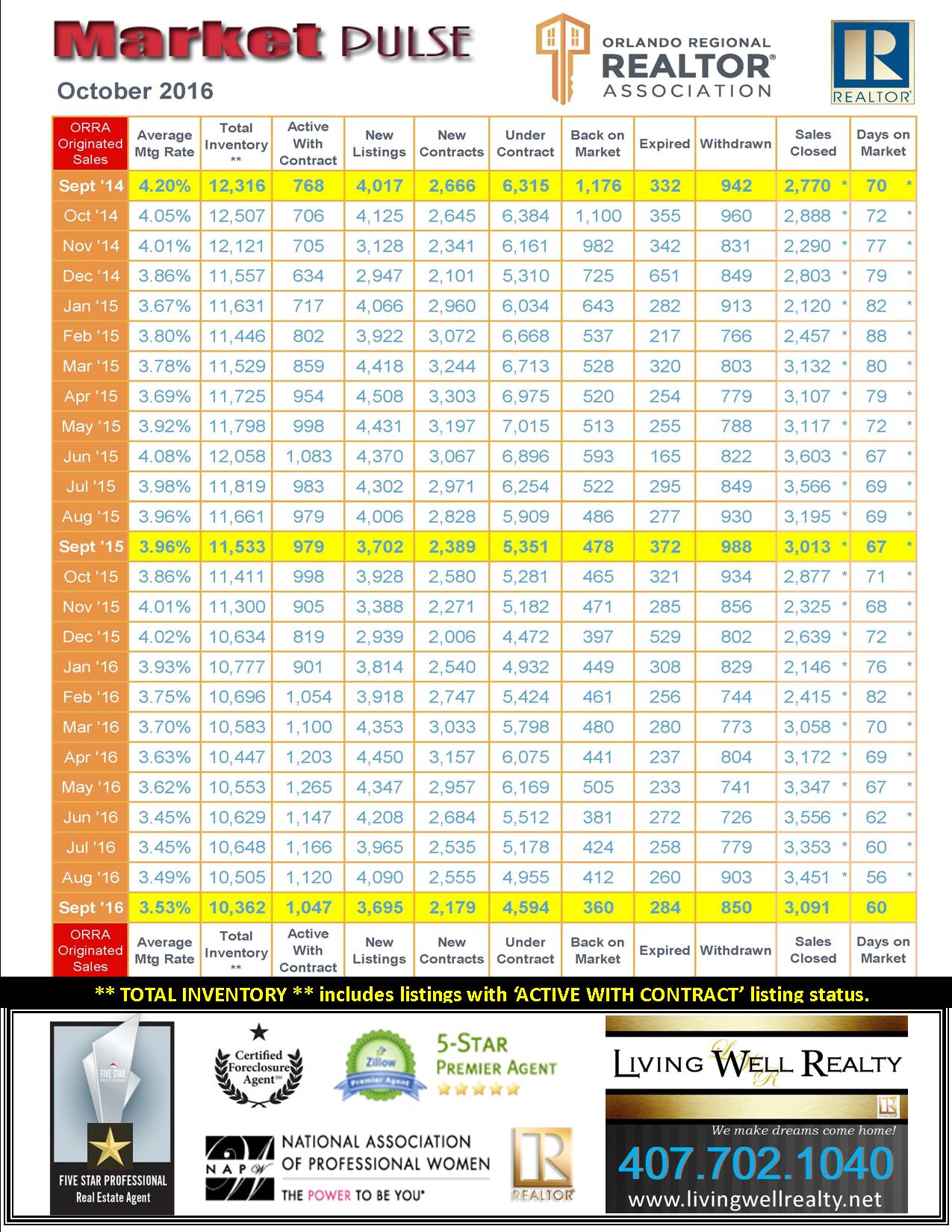

Summary OCTOBER 2016

Orlando home sales jumps 7 percent; median price rises 14 percent as inventory continues downward slide.

The median price of Orlando homes rose 12 percent year-over-year in September, while sales increased by 3 percent. The supply of homes available for purchase in the Orlando area slid downward by 10 percent.

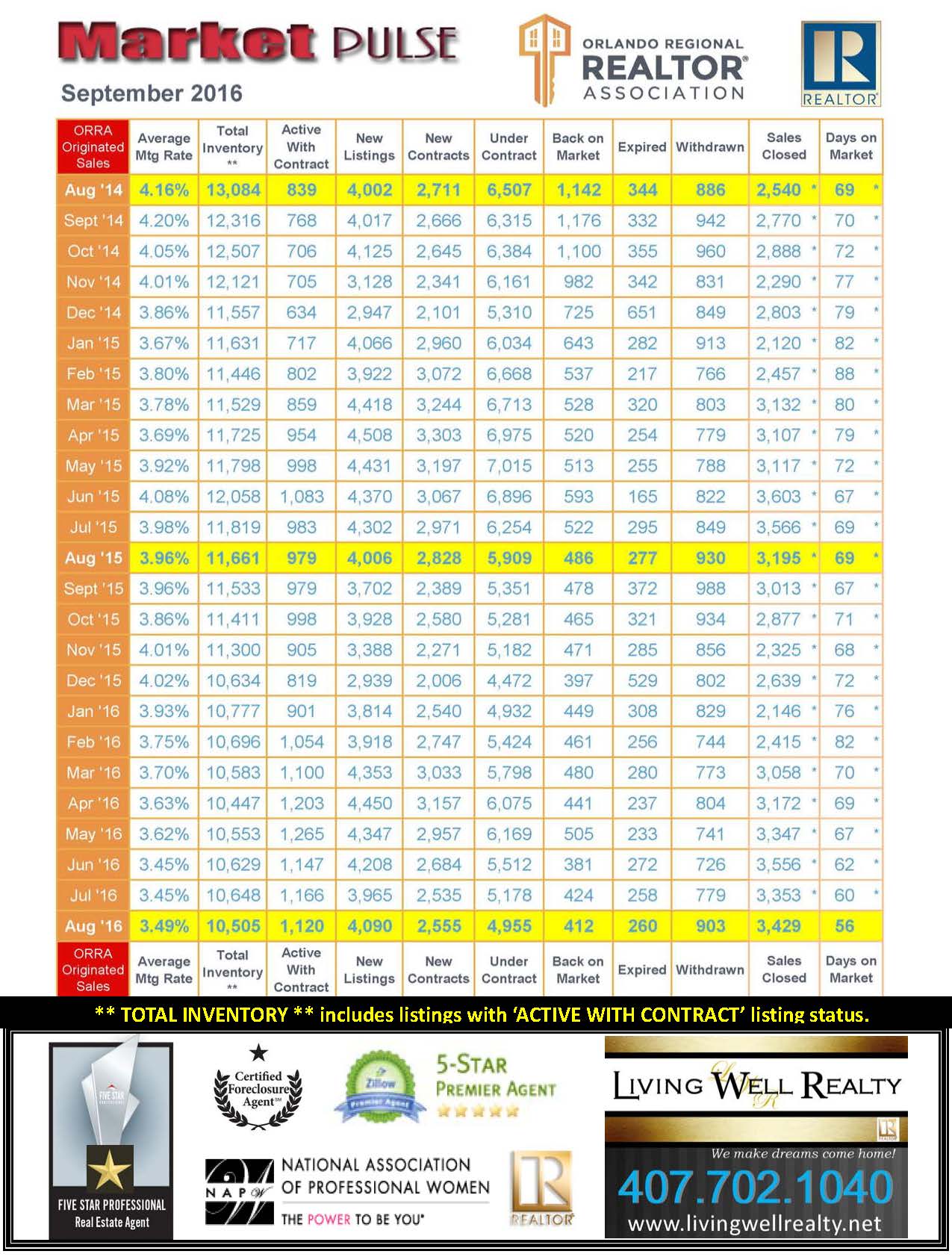

Summary SEPTEMBER 2016

Orlando home sales increase 3 per cent a median price continues upward march of 12 per cent.

Sales of homes in Orlando experienced a year-over-year increase of 7.32 percent for the month of August, reports the Orlando REALTOR Association. The jump occurred despite yet another 10 percent decrease in inventory which continues to contribute to the area’s sustained rise in median price.

Summary AUGUST 2016

Summary AUGUST 2016

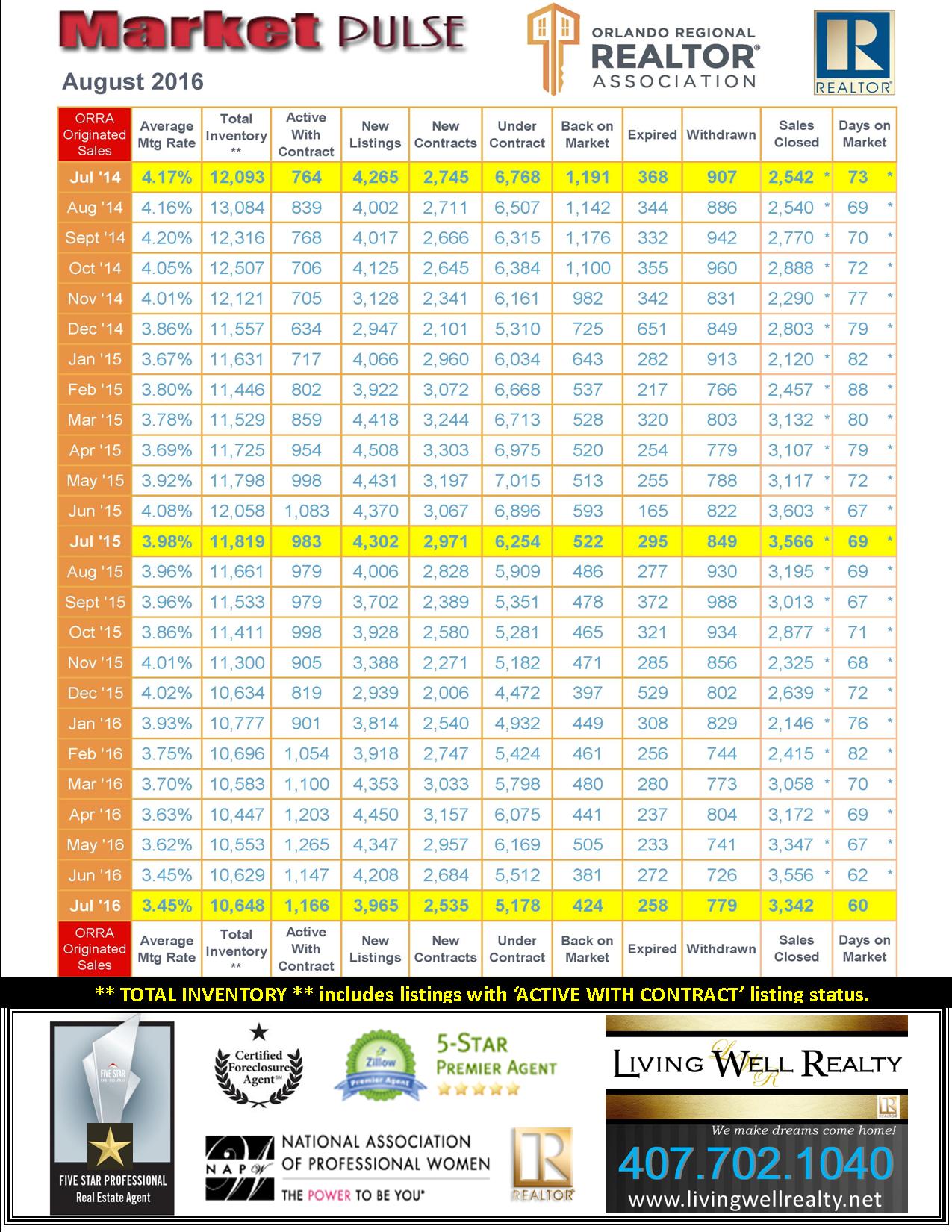

Orlando Median price jumps 12 percent amid declines in both inventory and sales.

The inventory of homes available for purchase in the Orlando area dropped by 9.91 percent in July 2016 compared to a 6.28 percent decrease in sales and a 12.04 percent increase in median price when compared to July of 2015.

MEDIAN PRICE:

The Orlando median home price has now experienced year-over-year increases for the past 60 consecutive months; as of July the median price is 77.82 percent higher than it was in July 2011.

The median price of single-family homes increased 14.5 percent when compared to July of last year and the median price of condos increased 9.20 percent.

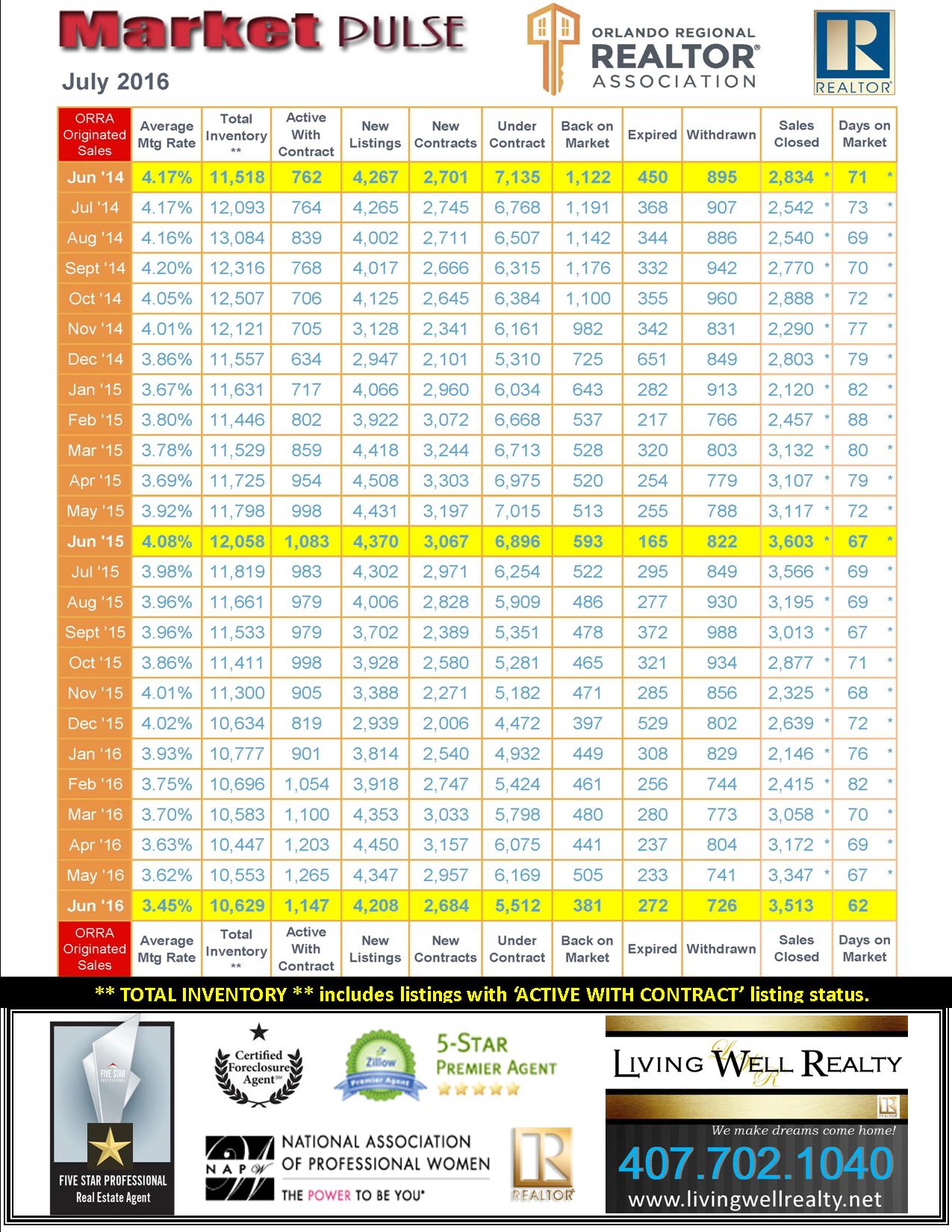

Summary JULY 2016

Decline in available inventory sends Orlando median home price soaring.

The median price of Orlando homes sold during the month of June increased 15 percent compared to June of last year, the result in part of yet another double-digit decline in inventory. Sales decreased by 3 percent when compared to June 2015, but increased by 5 percent when compared to last month.

MEDIAN PRICE:

The Orlando median home price has now experienced year-over-year increases for the past 59 consecutive months; as of June the median price is 79.22 percent higher than it was in July 2011.

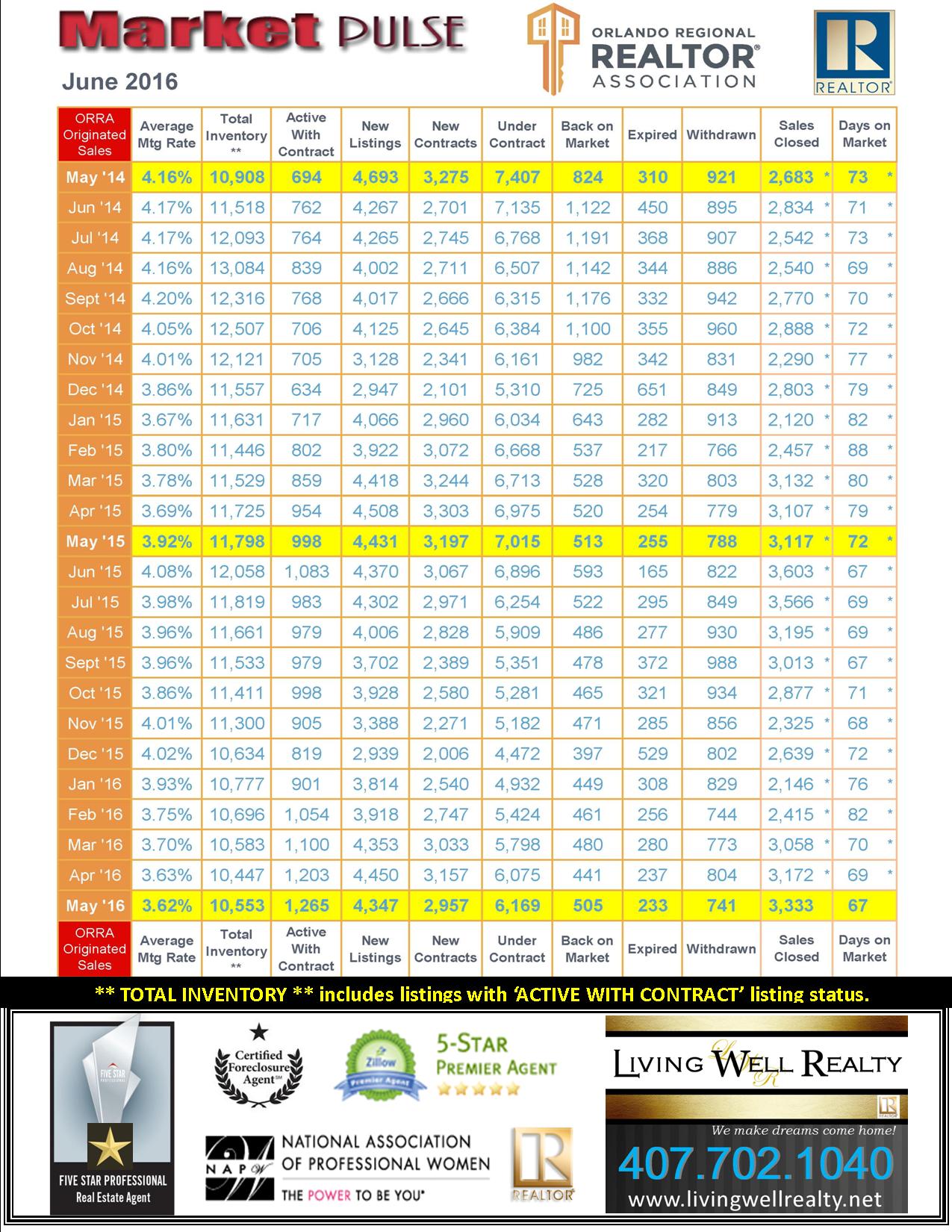

Summary JUNE 2016

Orlando’s home prices rise 7 percent, median price jumps 12 percent.

The median price of Orlando homes sold during the month of May increased more than 12 percent compared to May 2015 and crossed the $200,000 mark for the first time since August 2008. In addition, sales showed a year-over-year increase of nearly 7 percent despite a continuing slide in inventory.

MEDIAN PRICE:

The year-to-year median price of normal sales increased 7.00 percent, while the median price for foreclosure sales increased 10.31 percent and short sales increased 1.05 percent.The median price of single-family homes increased 10.68 percent when compared to May of last year, and the median price of condos increased 15.29 percent.

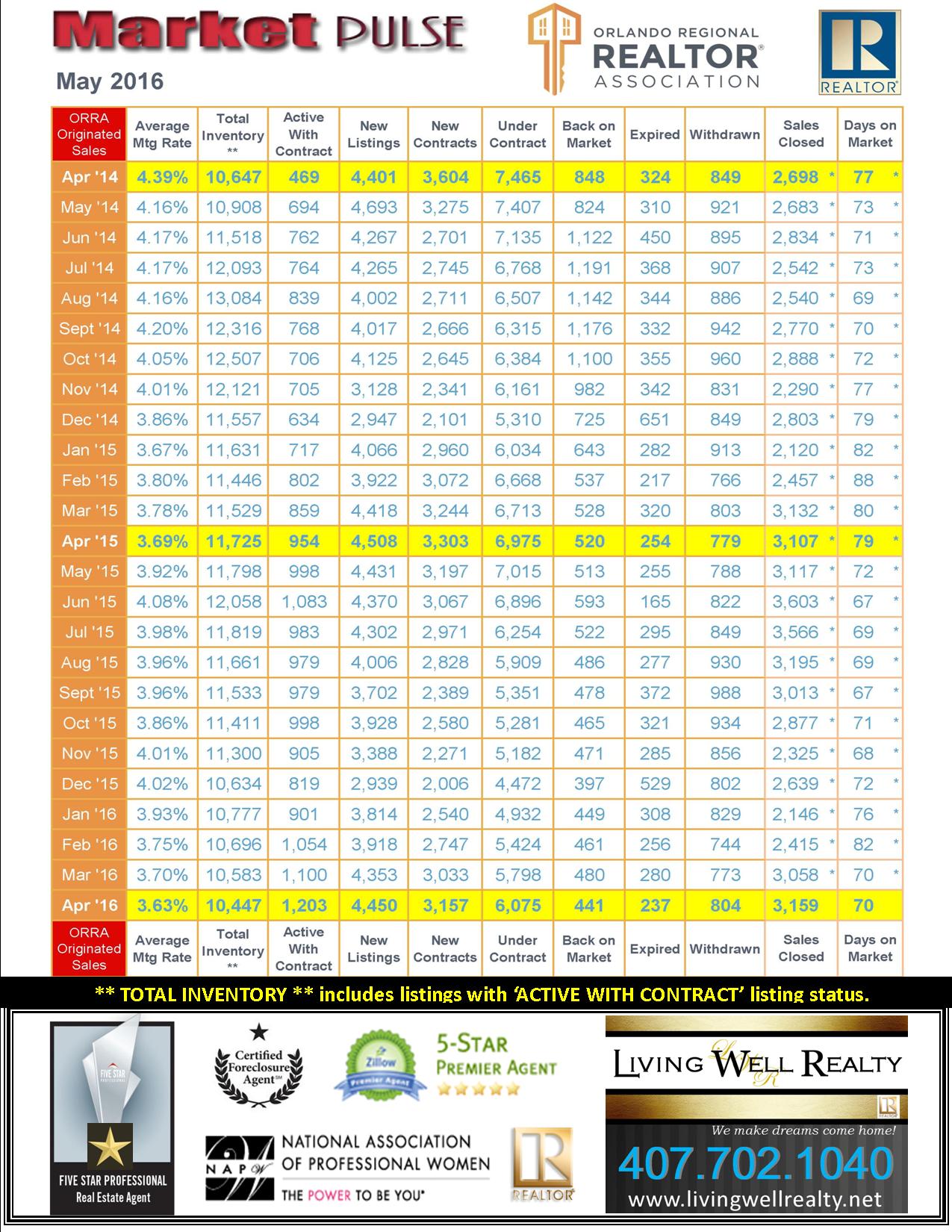

Summary MAY 2016

Orlando’s home inventory declines 11 percent in April, driving median price upward and impacting sales.

The median price of Orlando homes shot up nearly 10 percent in April compared to April 2015, while sales increased about two percent. Both the rise in values and the sluggish movement in sales continue be influenced by the area’s ever-declining inventory.

MEDIAN PRICE:

The Orlando median home price has now experienced year-over-year increases for the past 57 consecutive months, as of April the median price is 66.15 percent higher than it was in July 2011.

– The year-to-year median price of normal sales increased 1.55 percent, while the median price for foreclosure sales increased 11.66 percent and short sales increased 11.45 percent.

-The median price of single-family homes increased 7.73 percent when compared to April of last year, and the median price of condos increased 13.92 percent.

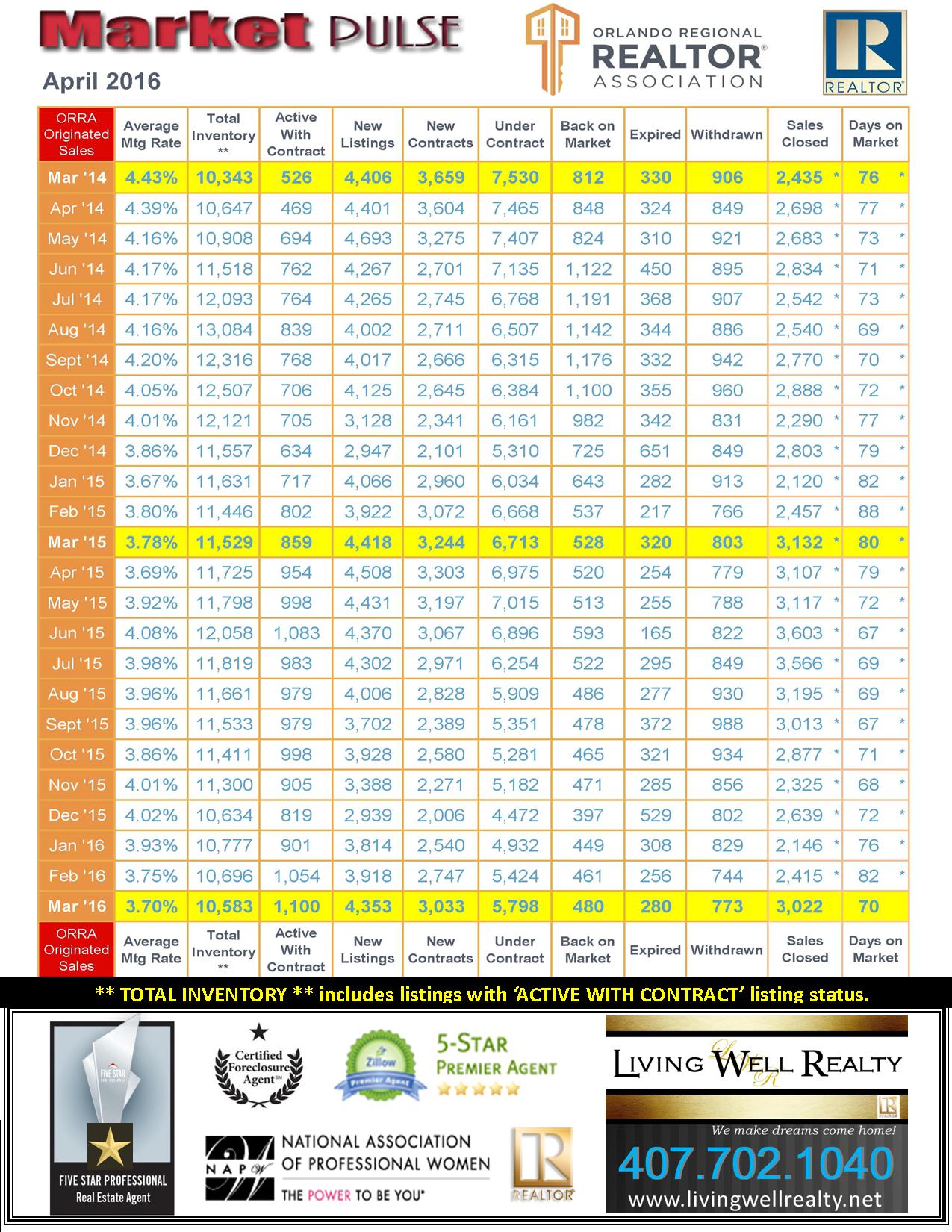

Summary APRIL 2016

Orlando home buying season kicks off with a decline in inventory, increase in median price

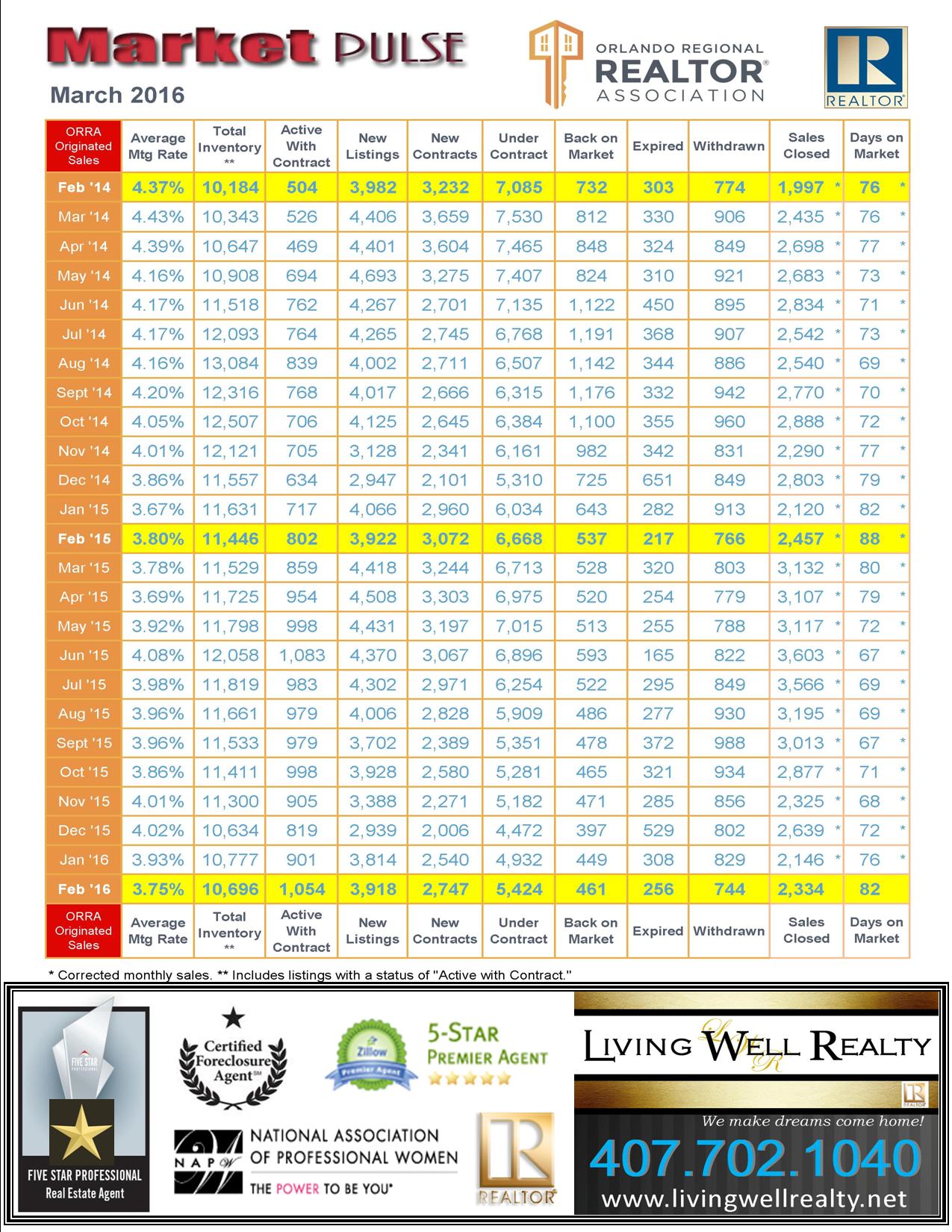

Summary MARCH 2016

Summary FEBRUARY 2016

Inventory declines drive Orlando home sales down, squeeze median price upward in January.

The median price of Orlando homes sold in January increased nearly 14 percent of January of 2015, amid an inventory level that has seen year-over-year decreases for the last seven months.

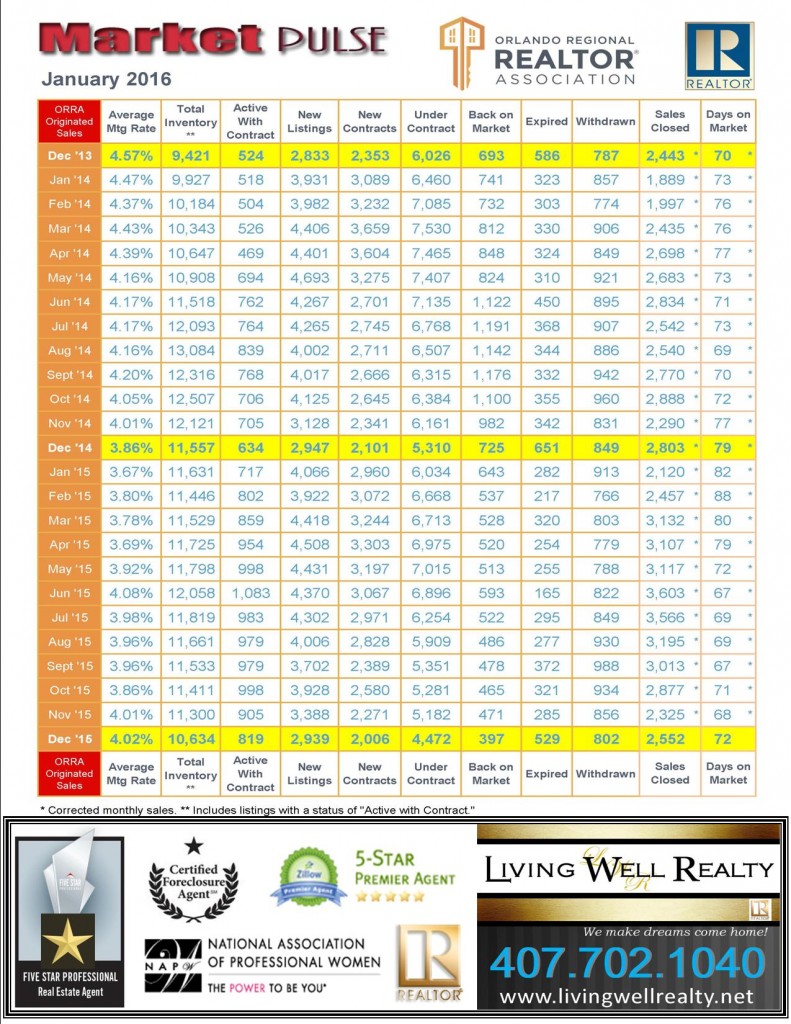

Summary JANUARY 2016

ORLANDO HOUSING MARKET ENDS 2015 WITH A 15 PERCENT INCREASE IN ANNUAL SALES; 9 PERCENT INCREASE IN MEDIAN PRICE!

Orlando’s 2015 median price ($178,788) finished a healthy 9.02 percent higher than the 2014 annual median price ($164,000), thanks to a full 12 months of year-over-year price increases. Sales for 2015 finished 15.46 percent above the cumulative total sales for 2014.

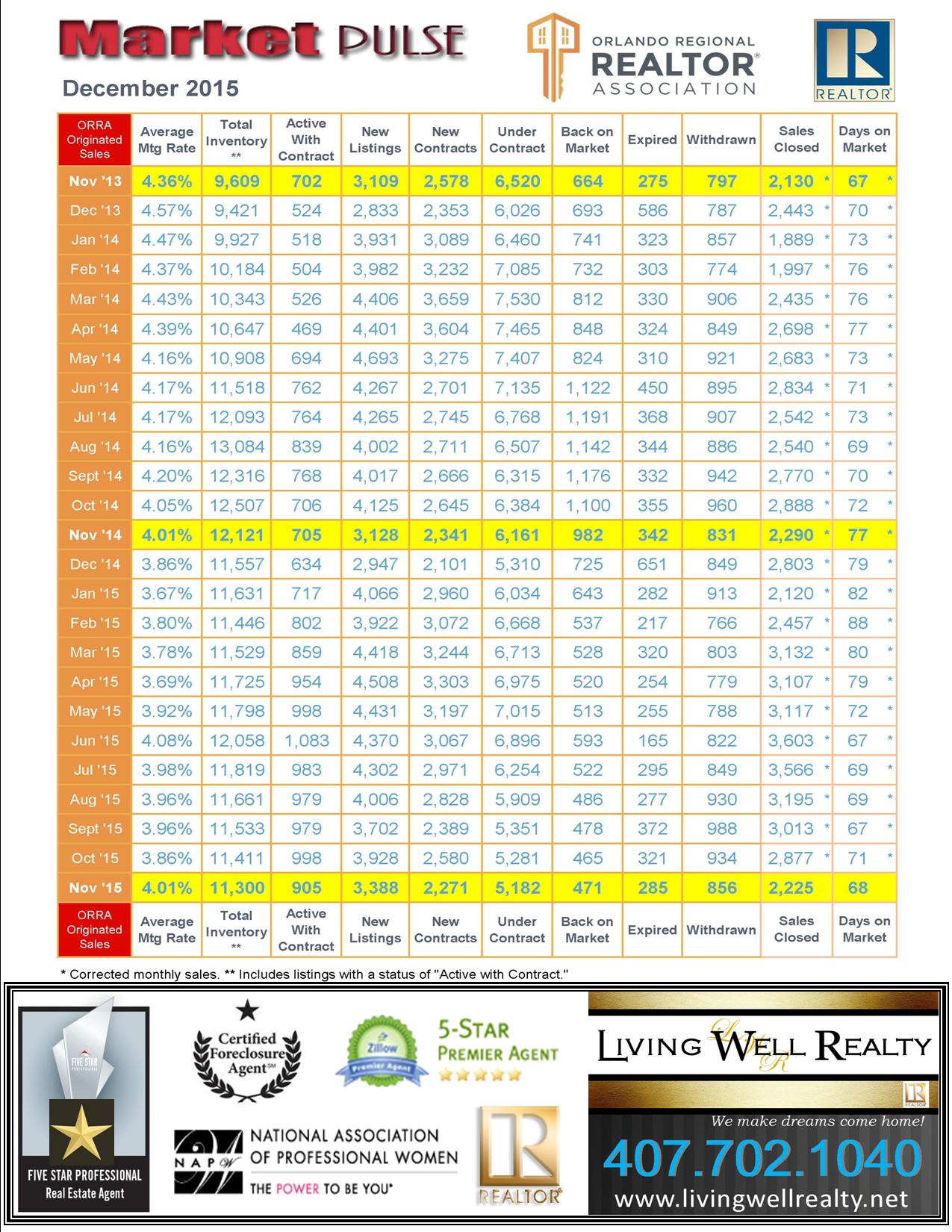

Summary DECEMBER 2015

ORLANDO MEDIAN PRICES RISE 10 PERCENT – SALES DROP 3 PER CENT

The Orlando median home price has now experienced year-over-year increases for 52 consecutive months; as of November the median price is 57.84 percent higher than it was in July 2011. (keep in mind in July 2011, we were not long in the beginning processes of recovery mode. According to Zillow, national home values still lag 6.8% below their pre-recession peak.)

Home sales in the Orlando area slipped 3 percent in November, as the inventory of available properties dropped for the fifth consecutive month. At the same time, the median home price rose 10.30 percent in November compared to November 2014.

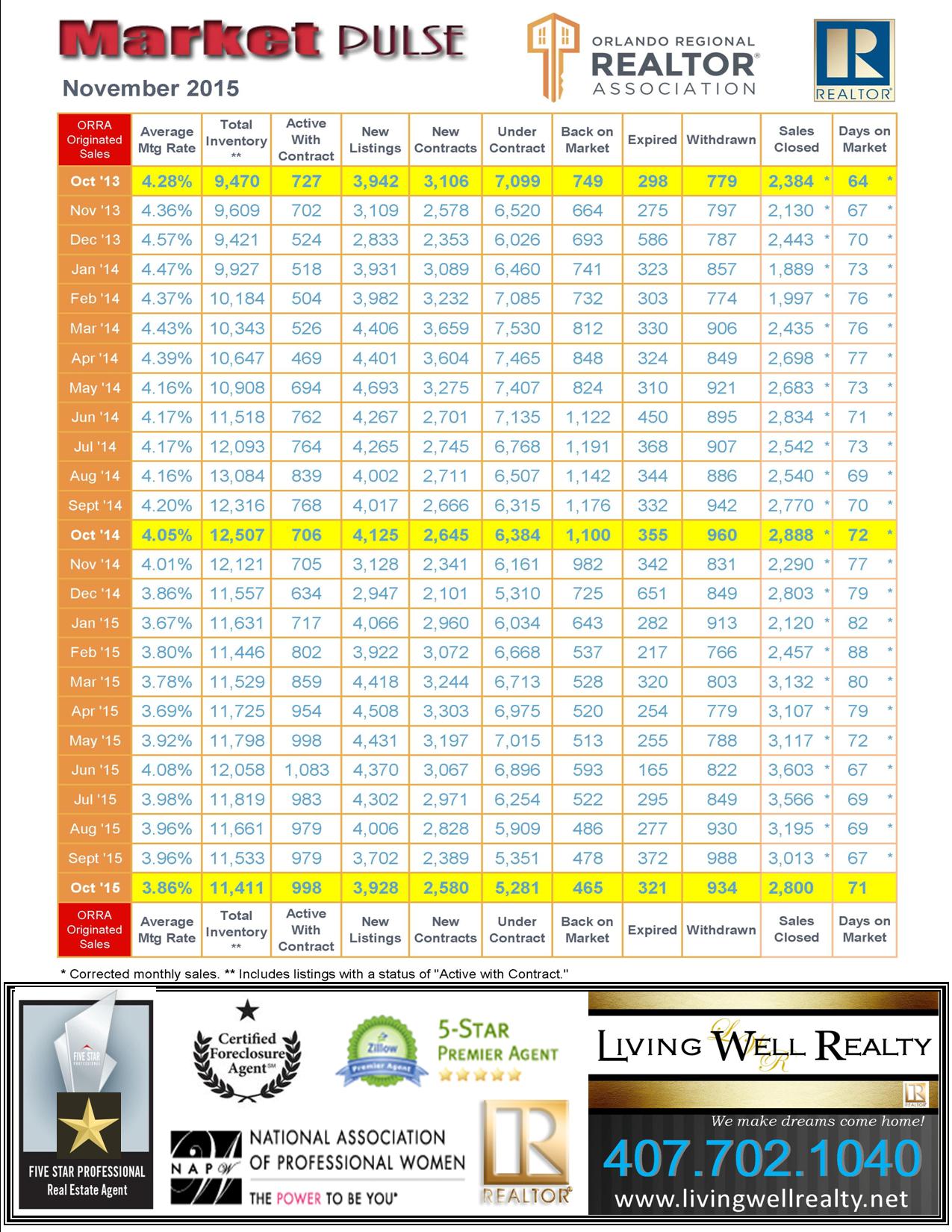

Summary NOVEMBER 2015

On the other hand, the median home price rose 12.50 percent in October compared to October 2014, which is the highest leap in year-over-year increases since May of 2014.

Summary OCTOBER 2015

Orlando home sales increase 3 percent, median price rises 9 percent

Summary SEPTEMBER 2015

Orlando home sales increase 22 percent; median price rises 11 percent

Orlando consumers chased the traditional summertime home buying wave to its tail end and racked up 22 percent more home sales in August of 2015 than in August of 2014. Buyer demand also helped swell the median home price by 11 percent, which marks the greatest month-over-month percentage increase this year.

Summary AUGUST 2015:

Orlando home sales increase 33 percent; median price rises 8 percent

Orlando’s summertime sales stampede continued through July, which saw closings of existing homes increase more than 33 percent, reports the Orlando Regional REALTOR® Association. In addition, the area’s median price experienced yet another rise in July, marking 48 consecutive months of year-to-year increases. The July 2015 median price is now 59.20 percent higher than in July 2011.

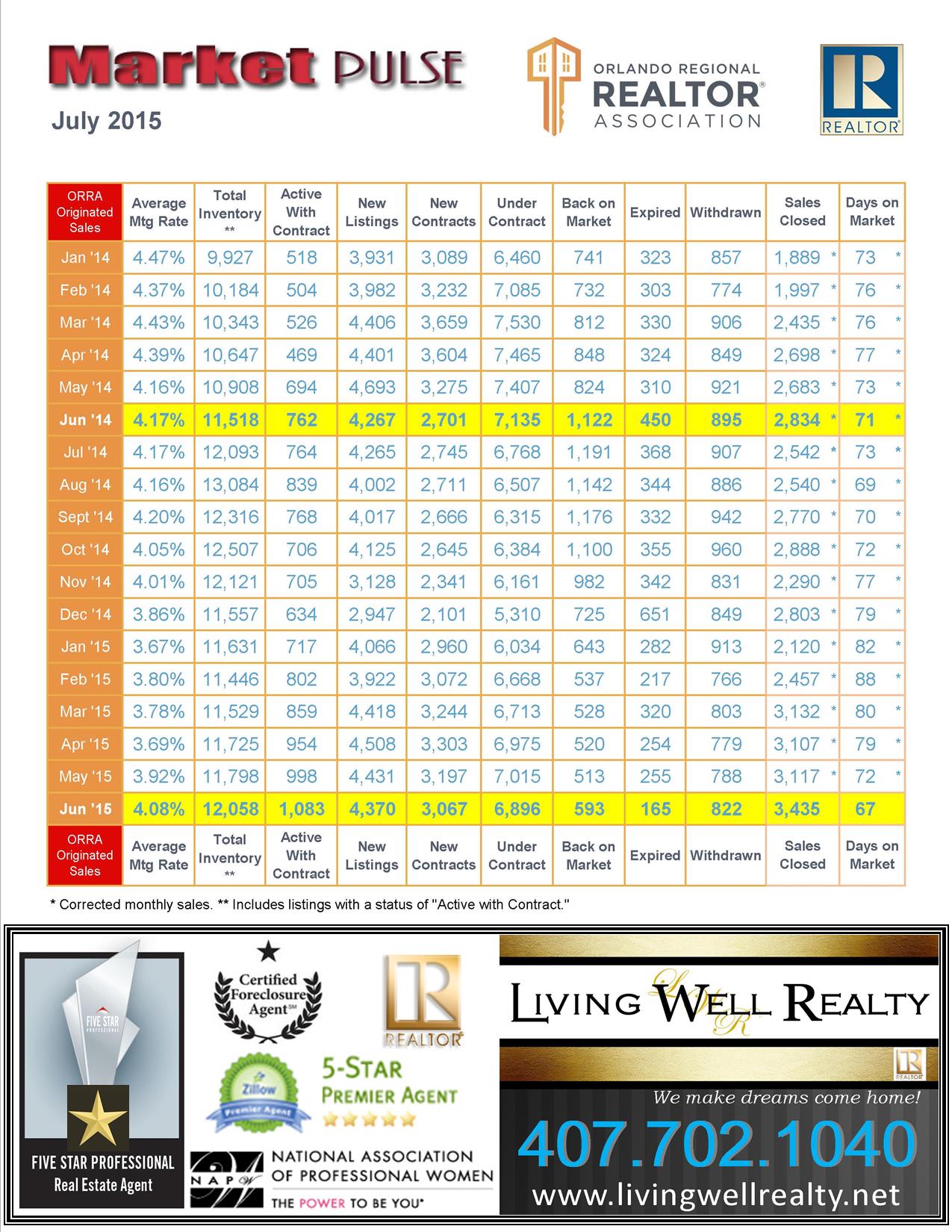

Summary JULY 2015:

Orlando home sales skyrocket 21 percent in June

A leap in “normal” transactions has boosted Orlando area home sales more than 21 percent over June 2014 and to its highest number (3,435) since the Orlando Regional REALTOR® Association began recording sales. In addition to skyrocketing sales, the median price for existing homes sold in June increased 7.73 percent.

Summary June 2015:

Orlando home sales, median price both up 10 percent in May!

Orlando’s housing market is riding its traditional summertime wave of home sales — fueled in part by both low interest rates and more inventory — and posted positive numbers for the month of May. Sales of existing homes increased 10 percent while the median price also increased 10 percent when compared to May of 2014, reports the Orlando Regional REALTOR® Association.

Summary May 2015:

Orlando home sales increase 12 percent; median price up 8 percent

Summary April 2015:

Orlando home sales soar 26 percent in March

Existing homes for sale in the Orlando area flew off the shelves in March, which saw a more than 25 percent increase in the number of transactions compared to March of 2014. The area’s overall median price (all sales types and all home types combined) increased more than 10 percent in that same March-to-March comparison.

The median price for March is the highest since October 2008, while the number of sales is the highest since June 2010.

Summary March 2015:

Orlando home sales leap 19 percent; median price rises 4 percent

Sales of existing homes in the Orlando area took a big jump last month, with nearly 20 percent more homes closing in February 2015 than in February 2014. In addition, the area’s overall median price (all sales types and all home types combined) increased nearly 5 percent in that same February-to-February comparison.

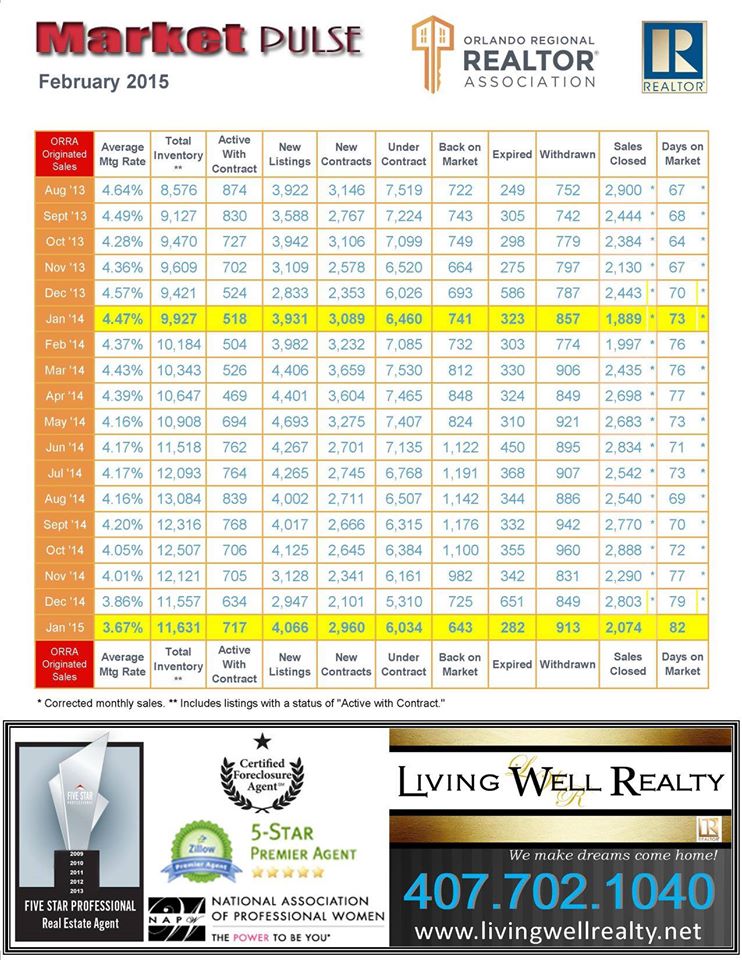

February 2015 Report

The Orlando housing market enjoyed healthy January-to-January comparison increases in both sales and median price as we head into the annual home buying season. The overall median price for January 2015 is 3.68 percent higher than in January 2014, while closings of all home types and all sale types combined is 9.79 percent higher compared to January 2014. Orlando home sales increased 10 per cent as interest rates fell to a new 19 month low!